AZURE HOLDING GROUP

WE ACQUIRE AND GROW

UNDERCAPITALIZED

OIL & GAS COMPANIES

IN THE PERMIAN BASIN

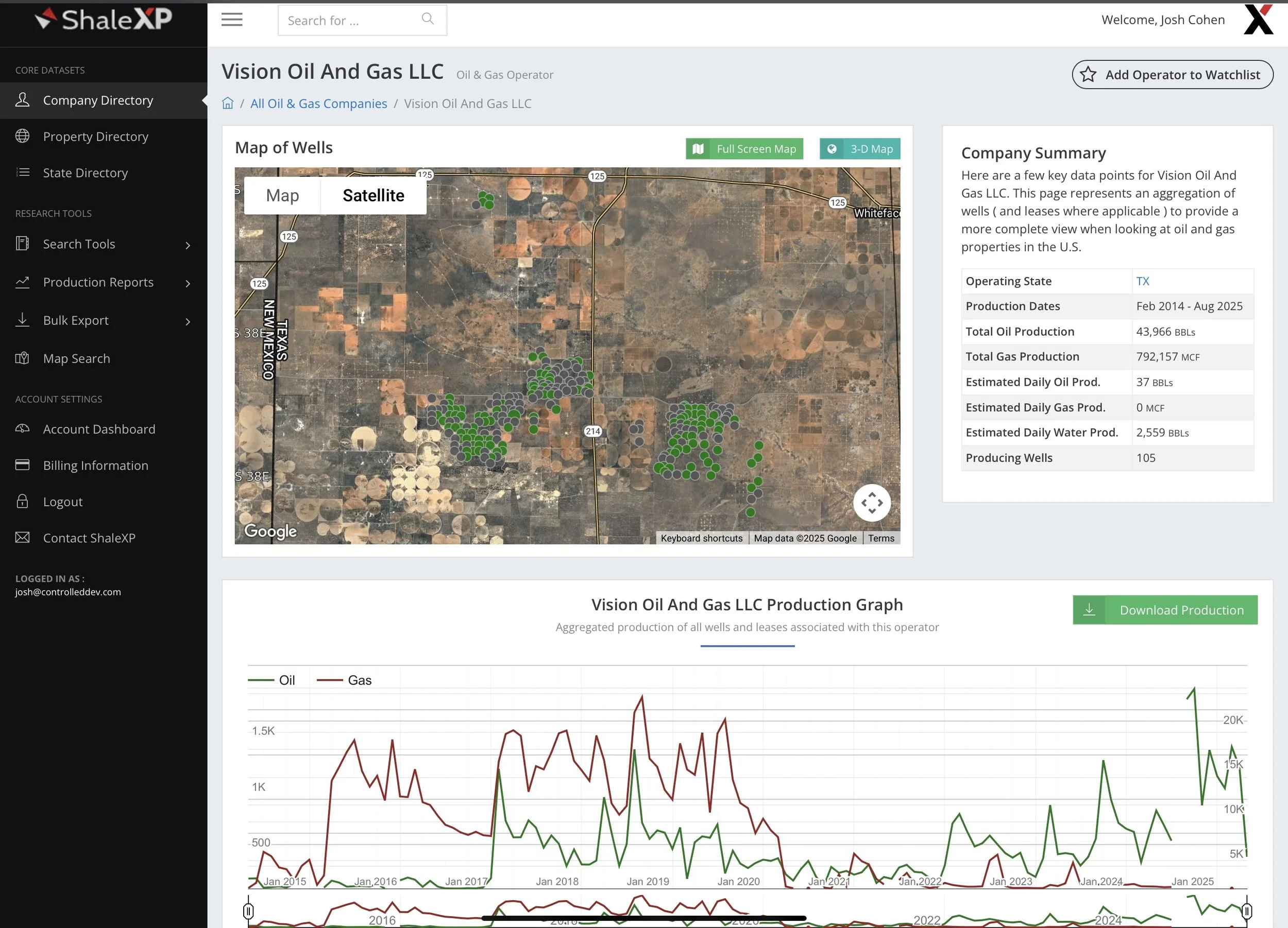

As a result of the Merger, Azure Holding Group will be renamed Vision Oil And Gas. The merger brings with it 102 actively producing oil & gas wells, 241 shut-in wells (of which at least 120 have been identified as a workover candidate), and 42 injection wells spread primarily across 18,300 Acres on Tier 3 acreage in Cochran County in the Permian Basin. The merger also brings an additional 31 wells in South Texas located across 6,000 acres in Nueces, Duval, Bee, Webb, Starr and Zapata Counties in South Texas.

As a result of the Merger, Azure Holding Group will be renamed Vision Oil And Gas. The merger brings with it 102 actively producing oil & gas wells, 241 shut-in wells (of which at least 120 have been identified as a workover candidate), and 42 injection wells spread primarily across 18,300 Acres on Tier 3 acreage in Cochran County in the Permian Basin. The merger also brings an additional 31 wells in South Texas located across 6,000 acres in Nueces, Duval, Bee, Webb, Starr and Zapata Counties in South Texas.

The group believes that it will achieve between 200 to 250 barrels a day of production through it's first phase of remediation by December 2025, focusing on recovery efforts in the San Andreas formation where the wells are currently producing at depths varying between 5,000 and 5,000 feet. The company also intends to complete it's remediation efforts across it's South Texas assets by December 2025, adding between 50 to 80 BOED in production.

In Q1 2026, the group will begin it's evaluation re-entry into the Devonian through Vertical re-entry efforts across the existing wellbores. The Company's efforts are supported by a single direct offsetting well that is operated by an unrelated party, and that has produced over 275,000 cumulative barrels of oil at a depth of 12,600 feet, with a well location that is less than 3,000 feet away from over 7 of Vision Oil And Gas's existing San Andreas wells (the company's leases in Cochran County includes deep rights). If these test well re-entries prove successful, the company has identified over 200 existing and 200 new well locations to allow for vertical re-entry in the Devonian.

The company intends to self service it's own workovers, leveraging the expertise inhouse across it's team, and to ensure CAPEX and Lease Operating Expense efficiency, as well as execution against it's Capital Plans. The Company intends to partner with Service Companies that are well positioned to grow and scale with an emerging Independent Operator, and is open to entering into Master Service Agreements with the right counterparties.